Muscat: Asyad Group SAOC (“Asyad Group”), a prominent global integrated logistics provider, today announces its intention to offer at least 20% of the issued share capital in Asyad Shipping Company SAOG (under transformation) (“Asyad Shipping” or “ASC” or “the Company”), one of the world’s largest diversified maritime shipping companies, through an Initial Public Offering (“IPO” or the “Offering”) and to list its ordinary shares for trading on the Muscat Stock Exchange (“MSX”).

The Offering comes as part of Asyad Group's vision to drive its operational growth, diversify its business portfolio, and achieve sustainability and long-term growth. Since its inception through the end of 2023, Asyad Group has consistently delivered a strong and sustainable financial performance, achieving a remarkable compound annual growth rate (CAGR) of 21% in revenue and 73% in net profit. This growth has been underpinned by the Group's expansion into over 90 geographical markets, including into major global economies such as China, India, the United States, and the GCC.

Asyad Group’s success is anchored in its competitive strategy to address global market needs with integrated logistics solutions. This has been made possible by the efforts of a dedicated team of more than 10,000 members who have propelled exceptional growth in the Group’s commercial and operational performance. By combining innovation, expertise, and a customer-centric approach, Asyad Group has established itself as a global leader in the logistics sector.

Established in 2003, Asyad Shipping is one of the world’s largest providers of diverse shipping and maritime solutions. It is competitively positioned to meet the needs of high-growth markets such as Asia, the Middle East, North Africa, Europe and the Americas. ASC operates 89 multi-purpose vessels reaching over 60 countries, linking Omani and global ports, and providing reliable and competitive shipping solutions to all major industrial sectors. It is also distinguished by its long-standing strategic and commercial partnerships with many major international clients, reinforcing its position as a leader in the global shipping and maritime transportation sector.

Wholly owned by Asyad Group, Asyad Shipping leverages the Group's advanced infrastructure and shared resources to provide comprehensive solutions to customers around the world. Additionally, its integration within Asyad Group's major ports, economic and free zones supports the efficient handling, exporting and importing of cargo and containers with reduced waiting times at ports, and thus maximizes its competitiveness and sustainable business growth across major markets.

Sohar International Bank has been appointed as the issue manager (“Issue Manager”). Oman Investment Bank, Sohar International Bank, EFG Hermes, Jefferies and JP Morgan, have been appointed as joint global coordinators (the “Joint Global Coordinators”). Crédit Agricole Corporate and Investment Bank and Société Générale have been appointed as joint bookrunners.

KEY DETAILS OF THE OFFERING

Asyad Group SAOC (the “Selling Shareholder”) owns 100% of Asyad Shipping prior to the Offering. The Selling Shareholder expects to offer at least 20% of the total issued share capital of Asyad Shipping, with the Selling Shareholder retaining the right to amend the size of the Offering at any time at their sole discretion in line with the applicable laws and the approval of the FSA. Immediately following the Offering, Asyad Group SAOC will remain the majority shareholder of Asyad Shipping.

The Offering will be offered in two tranches to eligible and qualified institutional investors in Oman and other institutional investors in a number of countries (the "Category I Investors") and retail investors in Oman ("Category II Investors"). It will be conducted in the manner approved by the FSA and will be carried out concurrently.

Category I (Institutional Tranche) Offer represents 75% of the total Offering and will be made to eligible investors in Oman and qualified institutional and other investors in several countries, with allocation of Offer Shares determined by the Selling Shareholder in consultation with the Joint Global Coordinators. Of the 75% of Offer Shares allotted to the Institutional Tranche, 30% of Offer Shares have been allocated for Anchor Investors.

Category II (Retail Tranche) Offer represents 25% of the total Offering for retail investors in Oman.

The Offering is being made available: (i) in Oman in accordance with Omani laws (including the SAOG Executive Regulations); and (ii) outside the United States to certain institutional investors in reliance on Regulation S (“Regulation S”) under the U.S. Securities Act of 1933, as amended (the “Securities Act”). Further information on the eligibility requirements for participation in the Offering will be available in the Offering Document upon its publication.

The subscription period for Category I and Category II investors is expected to commence in February 2025, after receiving the required approval from the FSA.

Further details of the Offering, the Category I Offer and the Category II Offer will be included in the Offering Document which is expected to be published by ASC prior to the start of the subscription period. The completion of the Offering and Listing of the shares to trading is subject to market conditions and obtaining relevant regulatory approvals in Oman, including approval of the Listing.

The shares held by the Selling Shareholder following completion of the Offering shall be subject to a lockup which starts on the date of Listing and ends 180 calendar days thereafter, subject to customary exceptions and waiver by the Joint Global Coordinators. The Company will also be subject to a lock-up starting on the date of the Listing and ending 180 calendar days thereafter.

OVERVIEW OF ASYAD SHIPPING COMPANY SAOG (under transformation)

Asyad Shipping Company is one of the world’s largest diversified maritime providers and a global leader in deep-sea transportation with a full suite of operational capabilities, including liner services, ship management and chartering activities. Based in Oman, the company operates 89 vessels reaching over 60 countries. Established in 2003, the Company has developed fully integrated operations and cultivated longstanding relationships with a diverse and international top-tier customer base.

Asyad Shipping Company offers a comprehensive range of maritime shipping solutions across five key business segments: Container Ships, Product Tankers, Dry Bulk Carriers, Crude Tankers, and Gas Carriers. The Liner Shipping segment, operated through its subsidiary Asyad Line Co. (“ASL”), connects Omani ports to strategic markets in the GCC, China, and Southeast Asia, while also providing value-added services such as storage, transportation, and customs clearance. Additionally, ASC transports crude oil, liquid cargoes like refined petroleum and chemicals, and handles both raw materials and finished goods under long-term contracts in the metallurgical sector.

Asyad Shipping also plays a pivotal role in global LNG and LPG transportation and is poised for growth with plans to expand its fleet by adding two eco-friendly LNG carriers, reinforcing its commitment to sustainability and innovation.

Moreover, ASC offers full-fledged maritime transportation services of the highest industry standards through its subsidiaries, including Oman Charter Company (“OCC”), Oman Ship Management Company (“OSMC”), Asyad Ship Management Company SPC (“ASMC”), ASL, and Asyad Shipping Pte Ltd (Singapore). These services include chartering activities for ASC-owned and third-party ships, as well as the commercial management of vessels that have been chartered-in to support the Company’s customers.

Since 2003, ASC has supported Oman’s national shipping fleet in alignment with the government's vision for the country’s industry-related transportation needs. Backed by Oman Investment Authority (“OIA”), the Company is a first-choice partner for major projects and clients in Oman particularly for OIA’s portfolio companies and other leading national firms where OIA has strong relationships. ASC’s shipping operations are vital to the logistics sector in Oman and the GCC. As part of Asyad Group’s integrated ecosystem, ASC contributes to enhancing the competitiveness of the logistics sector in regional and international markets. The Company’s commitment to global health, safety and sustainability standards is an integral part of its strategy. ASC efficiently invests in its fleet to help decarbonize Oman’s maritime industry.

With one of the largest globally diversified fleets, ASC is competitively positioned to supply high-growth markets, such as Asia, the Middle East and North Africa through its fleet of 89 vessels, with a total aggregate capacity of more than 9.5 million DWT as of 30 September 2024.

KEY INVESTMENT HIGHLIGHTS

A world-class shipping platform based in a strategic location with global reach

ASC operates a diverse fleet of 89 vessels, covering core segments comprising Container Ships, Product Tankers, Dry Bulk Carriers, Crude Tankers, and Gas Carriers, along with specialized shipping solutions. It maintains a young, high-utilization fleet with in-house commercial and technical support services.

Leveraging Oman’s strategic location, ASC serves over 60 countries, benefits from Oman’s maritime infrastructure and access to key markets in Asia, Africa, and Europe.

Strong market outlook across Asyad Shipping Company’s core segments underpinned by growing shipping demand and need for aging fleet replacement

The Company benefits from positive global supply-demand dynamics across its segments, driven by stable growth in global oil production and consumption (particularly in Asia-Pacific), and expanding refining capacity and demand for refined products.

In the LNG market, expanding infrastructure and the growth of end-user markets continue to drive robust demand, with the majority of vessels already secured under contracts. Additionally, global economic growth serves as a pivotal driver for demand in liner shipping, reinforcing its critical role in facilitating international trade.

ASC is well-positioned to leverage growth in Omani oil, gas, and LNG production, as well as advancements in green hydrogen projects. As a preferred partner for strategic Omani clients, it stands to benefit from strong economic and project growth in Oman.

Robust revenue backlog underpinned by long-term relationships with top-tier customers, providing significant cash flow visibility

The Company maintains long-term contracted partnerships with global leaders in commodities and trading, which ensure a strong revenue backlog and cash flow stability. As of 30 September 2024, the revenue backlog was USD 1.9 billion, with firm commitments covering the next decade.

ASC has a high conversion rate for contract extensions, reflecting strong customer relationships.

The Company leverages long-standing relationships with leading regional clients and boasts a diversified customer base, with its top five customers contributing less than 35% of the 2023 revenue, ensuring reduced dependency on any single customer.

Solid, predictable and growing financial profile supported by strong margins

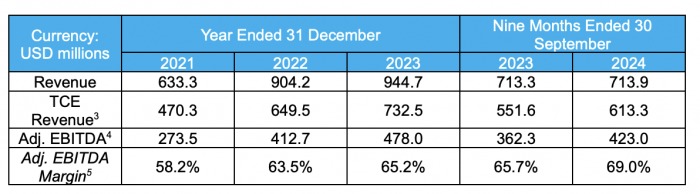

The Company’s strong balance sheet is supported by industry-leading Adjusted EBITDA margins, which grew from 58% in 2021 to 65% in 2023, driven by a low-cost base, operational excellence, and effective contract management. TCE Revenue increased at a CAGR of 25% from USD 470 million in 2021 to USD 733 million in 2023.

ASC maintains high cash conversion and continuous capital expenditure investments, achieving substantial returns from strategic expenditure programs. It has consistently maintained a positive cash position and strong cash flow margins, enabling self-financing of operations and capital needs.

The Company has successfully optimized its leverage profile, aided by strong relationships with lenders and favourable debt costs, ensuring sustained financial stability and growth.

Clear growth strategy to develop in priority segments

ASC has strategically expanded and optimized its fleet through both newbuild programs and second-hand acquisitions, enhancing its market position and forming valuable long-term partnerships by diversifying beyond LNG vessels to include crude tankers, product tankers, and dry bulk carriers.

Notable developments include diversifying its fleet beginning in 2007, operating dry bulk carriers in addition to tankers beginning in 2011, and partnering with Shell in 2015 to expand its Products Shipping fleet.

With planned investments of USD 2.3 billion to USD 2.7 billion in the medium term, which will be funded through a combination of internal company sources and external bank financing, the Company aims to capitalize on market dynamics while maintaining a strong focus on sustainable growth, profitability, and enhancing shareholder value.

Highly qualified management team backed by an experienced sovereign shareholder

ASC boasts a highly experienced management team, with a successful track record in maritime and shipping project delivery.

Management team has led the significant expansion of Asyad Shipping's fleet, driving revenue increases and achieving cost savings by improving operational efficiency as well as integrating ESG principles to enhance sustainability and reduce environmental impact.

Backed by strategic support from OIA and Asyad Group, the Company benefits from OIA's ecosystem and is a preferred partner for shipping requirements of OIA sister companies.

Driving and delivering on ESG initiatives to secure competitive advantages and strengthen market positioning

ASC is committed to strong environmental, health, and global safety standards, aligning with global sustainability goals and Oman's net-zero target for 2050. In 2023, the company saw a 2 per cent reduction of its carbon intensity indicator (“CII”) year over year and had zero spill incidents and lost time due to injury.

The Company has contributed USD 702 million to the Omani economy in 2022, supported job creation, and upscaled local talent, contributing approximately USD 27.5 million in in-country value in 2023.

ASC’s ESG strategy is overseen by a dedicated committee and approved by the Company’s Board of Directors. All employees have signed the comprehensive Code of Conduct.

The Company has also maintained its focus on health and safety, with zero lost time due to injury in 2023.

FINANCIAL PERFORMANCE AND OPERATIONAL HIGHLIGHTS

The Company’s revenue grew at a CAGR of 22% from 2021 to 2023, while its Adj. EBITDA achieved a CAGR of 32% during the same period, highlighting ASC’s strong financial momentum. The Company achieved revenue of USD 944.7 million in 2023 and USD 713.9 million for the first nine months of 2024.

In addition to its revenue, ASC reported Time Charter Equivalent (TCE) Revenue growing at a CAGR of 25% from 2021 to 2023. The Company reported TCE Revenue of USD 732.5 million in 2023 and USD 613.3 million for the first nine months of 2024. This strong financial performance is further supported by robust Adj. EBITDA margins of 65.2% in 2023 and 69.0% for the first nine months of 2024, reflecting ASC’s efficient cost management and high utilization rates across its fleet.

ASC’s robust operational framework is further underpinned by a significant revenue backlog of USD 1.9 billion as of September 30, 2024, providing long-term cash flow visibility. This backlog reflects the strength of the Company’s long-term partnerships with global industry leaders such as BP, Shell, and Trafigura, underscoring its credibility in international markets. The Company’s strong customer relationships have resulted in high extension rates for long-term contracts, ensuring operational stability through market cycles.

DIVIDEND POLICY & CAPITAL STRUCTURE

ASC intends to declare dividends based on the latest audited net income, to be paid semi-annually beginning in September 2025 for the six months ending 30 June 2025. For the years ended 31 December 2025 and 2026, the Company expects to declare a fixed annual dividend of USD 150 million (approximately OMR 58 million), 50 per cent. of which, amounting to USD 75 million (approximately OMR 29 million), is expected to be paid in September, and the remaining 50 per cent. of which, amounting to USD 75 million (approximately OMR 29 million), is expected to be paid in March of the following year. For the year ended 31 December 2027, the Company expects to declare a dividend based on 95 per cent. of the audited net income for the year ended 31 December 2027. ASC intends to pay out dividends for the first six months of the year in September of that year and for the last six months of the year in March of the following year.

ASC intends to pay a dividend of USD 86.0 million (approximately OMR 33.1 million) on the basis of performance for the year ended 31 December 2024. This dividend will be paid only to existing, pre-IPO shareholders.

ASC intends to maintain a robust dividend policy designed to return to Shareholders substantially all of its distributable free cash flow after providing for growth opportunities and subject to credit rating considerations. The Company’s ability to pay dividends is dependent on a number of factors, including the availability of distributable reserves, its capital expenditure plans and other cash requirements in future periods, and there is no assurance that ASC will pay dividends or, if a dividend is paid, what the amount of such dividend will be. Any level or payment of dividends will be at the discretion of the Board and will be subject to the approval of an ordinary general meeting of the shareholders.

Asyad Shipping adopts a prudent yet strategic capital structure to support its long-term growth and operational flexibility. As of September 30, 2024, the Company reported net loans and borrowings of USD 1,210 million and USD 1,229 million including lease liability, primarily secured by vessel mortgages valued at USD 867 million. The Company’s Net Leverage (calculated as Net Debt including leases divided by Adjusted EBITDA) currently is at 2.3 times EBITDA as of 30 September 2024, down from 2.7 times EBITDA as of 31 December 2023. The Company’s Net Leverage (including lease liabilities) is targeted to be approximately 2.5 times EBITDA in 2025.

CORPORATE GOVERNANCE

The Board of Directors of ASC are committed to standards of corporate governance that are in line with best practice and to comply fully with the FSA’s Code of Corporate Governance for Public Joint Stock Companies (the “Code”). The Board of Directors consists of five members, of which two are independent directors as per the Code. The Board of Directors have established an audit committee and a nomination and remuneration committee, each comprising of three directors and have been established in accordance with the provisions of the Code.

FINANCIAL COMMUNICATIONS ADVISOR

Kevin Soady,

Partner, Kekst CNC

Nahed Ashour

Director, Kekst CNC

JOINT GLOBAL COORDINATORS

Oman Investment Bank

Sohar International

EFG-Hermes

Jefferies

JP Morgan

ISSUE MANAGER

Sohar International

JOINT BOOKRUNNERS

Crédit Agricole CIB

Société Générale

ELECTRONIC TRANSMISSION DISCLAIMER

This announcement is an advertisement for the purposes of the Prospectus Regulation EU 2017/129 and underlying legislation. It is not a prospectus. A copy of any prospectus published by Asyad Shipping Company SAOG (under transformation) (the “Company”) will, if approved and published, be made available for inspection on the issuer’s website subject to certain access restrictions.

The information contained in this announcement is for background purposes only and does not purport to be full or complete. No reliance may or should be placed by any person for any purposes whatsoever on the information contained in this announcement or on its completeness, accuracy or fairness. The information in this announcement is subject to change. No obligation is undertaken to update this announcement or to correct any inaccuracies, and the distribution of this announcement shall not be deemed to be any form of commitment on the part of the Company to proceed with the Offering or any transaction or arrangement referred to herein. This announcement has not been approved by any competent regulatory authority. None of the Joint Global Coordinators, the Issue Manager, the Joint Bookrunners, the Collection Agents and/or any of their respective subsidiaries, affiliates or any of their respective directors, officers, employees, advisers and/or agents are responsible for the contents of this announcement.

This announcement does not constitute or form part of any offer or invitation to sell or issue, or any solicitation of any offer to purchase or subscribe for any shares or any other securities nor shall it (or any part of it) or the fact of its distribution, form the basis of, or be relied on in connection with or act as an inducement to enter into, any contract or commitment whatsoever. Investors should not purchase any shares referred to in this announcement except on the basis of information in the Prospectus to be published by the Company in due course in connection with the proposed admission of the shares to listing and trading on the Muscat Stock Exchange. The Offering and the distribution of this announcement and other information in connection with the Offering in certain jurisdictions may be restricted by law and persons into whose possession this announcement, any document or other information referred to herein comes should inform themselves about, and observe, any such restrictions. Any failure to comply with these restrictions may constitute a violation of the securities laws of any such jurisdiction.

This announcement is not for distribution, directly or indirectly, in or into the United States (including its territories and possessions, any State of the United States and the District of Columbia), Canada, Australia, South Africa or Japan. This announcement does not constitute or form a part of any offer or solicitation to purchase or subscribe for, or otherwise invest in, securities in the United States. The securities mentioned herein have not been, and will not be, registered under the United States Securities Act of 1933 (the “Securities Act”) or with any securities regulatory authority of any state or other jurisdiction in the United States.

The securities may not be offered or sold in the United States absent registration except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act. There will be no public offer of securities in the United States.

This announcement is being distributed to and is only directed only at (i) persons who are outside the United Kingdom; (ii) investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”); (iii) high net worth entities falling within Article 49(2)(a) to (d) of the Orders; and (iv) other persons to whom it may lawfully be communicated (all such persons in (i), (ii), (iii) and (iv) above) together being referred to as “relevant persons”). Any invitation, offer or agreement to subscribe for, purchase or otherwise acquire securities will be engaged in only with relevant persons. Any person who is not a relevant person should not act or rely on this announcement or any of its contents.

In any member state of the European Economic Area, this announcement is only addressed to and is only directed at qualified investors in such member state within the meaning of the Prospectus Regulation EU 2017/1129 (the “Prospectus Regulation”), and no person that is not a qualified investor may act or rely on this announcement or any of its contents. In the United Kingdom, this announcement is only addressed to and is only directed at qualified investors within the meaning of the Prospectus Regulation as it forms part of domestic law by virtue of European Union (Withdrawal) Act 2018, and no person that is not a qualified investor may act or rely on this announcement or any of its contents.

In the Sultanate of Oman: This announcement and the information contained in it is strictly private and confidential and is being distributed to a select number of investors/recipients and must not be provided to any person other than the original recipient, and may not be reproduced or used for any other purpose. If you are in any doubt about the contents of this announcement, you should consult an authorised financial adviser. This announcement does not constitute an offer of securities in Oman as contemplated by the Commercial Companies Law of Oman (Royal Decree 18/2019) or Article 28 of the Omani Securities Law (Royal Decree 46/2022) (the “Relevant Oman Laws”). This announcement will only be made available to investors in Oman in accordance with the provisions of Relevant Oman Laws.

This announcement has not been filed with or approved by the Omani Financial Services Authority or any other regulatory authority in Oman. Any person in Oman to whom this announcement is made available and who invests in the securities concerned will be deemed to have represented and warranted that they are sophisticated investors (i.e., investors that have experience in investing in local and international securities, are financially solvent and have knowledge of the risks associated with investing in securities) and are acquainted with the announcements relating to the concerned issuance and the risks and rewards associated with investment in such securities.

In the United Arab Emirates (outside of the financial free zones established pursuant to UAE Federal Law No.8 of 2004): This announcement is strictly private and confidential and is being distributed to a limited number of investors/recipients and must not be provided to any person other than the original recipient, and may not be reproduced or used for any other purpose. If you are in any doubt about the contents of this announcement, you should consult an authorised financial adviser. By receiving this announcement, the person or entity to whom it has been issued understands, acknowledges and agrees that this announcement has not been approved by or filed with the United Arab Emirates (“UAE”) Central Bank, the Securities and Commodities Authority (the “SCA”) or any other authorities in the UAE. No marketing of any financial products or services has been or will be made from within the UAE other than in compliance with the laws of the UAE and no subscription to any securities or other investments may or will be consummated within the UAE.

Securities may not be marketed, offered or sold directly or indirectly to the public in the UAE without the approval of the SCA. This announcement does not constitute a public offer of securities in the UAE in accordance with the Federal Commercial Companies Law, No. 32 of 2021 (as amended or replaced from time to time) or otherwise.

This announcement may be distributed in the UAE only to “professional investors” (as defined in SCA Board of Directors’ Chairman Decision No.13/R.M of 2021 (as amended from time to time)) and may not be provided to any person other than the original recipient.

Nothing contained in this announcement is intended to constitute investment, legal, tax, accounting or other professional advice. This announcement is for your information only and nothing in this announcement is intended to endorse or recommend a particular course of action. Any person considering acquiring securities should consult with an appropriate professional for specific advice rendered based on their respective situation.

In the Dubai International Financial Centre: This document relates to an offer (“Offer”) which is not subject to any form of regulation or approval by the Dubai Financial Services Authority (“DFSA”).

The DFSA has not approved this announcement nor has any responsibility for reviewing or verifying any announcement or other announcements in connection with this the Offer. Accordingly, the DFSA has not approved this announcement or any other associated documents nor taken any steps to verify the information set out in this announcement, and has no responsibility for it.

The Offer has not been offered and will not be offered to any persons in the Dubai International Financial Centre except on that basis that an offer is:

(i) an “Exempt Offer” in accordance with the Markets Rules (“MKT”) module of the DFSA Rulebook; and

(ii) made only to persons who meet the “Deemed Professional Client” criteria set out in the Conduct of Business (“COB”) Module of the DFSA Rulebook (the “COB Module”).

This announcement must not, therefore, be delivered to, or relied on by, any other type of person.

The Offer to which this announcement relates may be illiquid and/or subject to restrictions on its resale. Prospective purchasers should conduct their own due diligence on the Offer.

The DFSA has not taken steps to verify the information set out in this announcement, and has no responsibility for it. If you do not understand the contents of this Offer or are unsure whether the securities to which this Offer relates are suitable for your individual investment objectives and circumstances, you should consult an authorised financial adviser.

This announcement is only addressed to and is only directed at “Deemed Professional Clients” as defined in the DFSA Rulebook, COB Module. This announcement is not directed at Retail Clients as defined in the COB Module.

In the Abu Dhabi Global Market (“ADGM”): This announcement relates to an offer (“Offer”) which is not subject to any form of regulation or approval by the Financial Services Regulatory Authority (“FSRA”).

The FSRA has not approved this announcement nor has any responsibility for reviewing or verifying any announcement or other announcements in connection with this the Offer. Accordingly, the FSRA has not approved this announcement or any other associated documents nor taken any steps to verify the information set out in this announcement, and has no responsibility for it.

The offered shares have not been offered and will not be offered to any persons in the ADGM except on the basis that an offer is: (i) an “Exempt Offer” in accordance with the FSRA Financial Services and Markets Regulations 2015 and Markets Rules; and (ii) made only to persons who meet the “Deemed Professional Client” criteria set out in the FSRA Conduct of Business Rulebook.

The FSRA has not taken steps to verify the information set out in this announcement, and has no responsibility for it. If you do not understand the contents of this Offer or are unsure whether the securities to which the Offer relates are suitable for your individual investment objectives and circumstances, you should consult an authorised financial adviser.

If you do not understand the contents of this announcement, you should consult an authorised financial adviser.

None of the Selling Shareholder, the Company, the Joint Global Coordinators, the Issue Manager, the Joint Bookrunners, the Collection Agents and/or any of their respective subsidiaries, affiliates or any of their respective directors, officers, employees, advisers, agents or any other person(s) accepts any responsibility or liability whatsoever for, or makes any representation or warranty, express or implied, as to the truth, accuracy, completeness or fairness of the information or opinions in this announcement (or whether any information has been omitted from this announcement) or any other information relating to the Company or associated companies, whether written, oral or in a visual or electronic form, and howsoever transmitted or made available or for any loss howsoever arising from any use of this announcement or its contents or otherwise arising in connection therewith.

This announcement does not constitute a recommendation concerning the Offering. The price and value of securities and any income from them can go down as well as up and you could lose your entire investment. Past performance is not a guide to future performance. Information in this announcement cannot be relied upon as a guide to future performance. Before purchasing any securities in the Company, persons viewing this announcement should ensure that they fully understand and accept the risks which will be set out in the Offering Document, when published. There is no guarantee that the Offering will take place and potential investors should not base their financial or investment decisions on the intentions of the Company or any other person in relation to the Offering at this stage. Nothing contained herein constitutes or should be construed as: (i) investment, tax, financial, accounting or legal advice; (ii) a representation that any investment or strategy is suitable or appropriate to your individual circumstances; or (iii) a personal recommendation to you. Potential investors should consult a professional adviser as to the suitability of the Offering for the person(s) concerned.

This announcement contains “forward-looking” statements, beliefs or opinions, including statements with respect to the business, financial condition, results of operations, liquidity, prospects, growth, strategy and plans of The Company, and the industry in which the Company operates. These forward-looking statements involve known and unknown risks and uncertainties, many of which are beyond the Company's control and all of which are based on the Company’s current beliefs and expectations about future events. Forward-looking statements are sometimes identified by the use of forward-looking terminology such as “believes”, “expects”, “may”, “will”, “could”, “should”, “shall”, “risk”, “intends”, “estimates”, “aims”, “plans”, “predicts”, “continues”, “assumes”, “targets”, “ongoing”, “positioned” or “anticipates” or the negative thereof, other variations thereon or comparable terminology or by discussions of strategy, plans, objectives, goals, future events or intentions. These forward-looking statements include all matters that are not historical facts and involve predictions. Forward-looking statements may and often do differ materially from actual results. They appear in a number of places throughout this announcement and include statements regarding the intentions, beliefs or current expectations of the directors or the Company with respect to future events and are subject to risks relating to future events and other risks, uncertainties and assumptions relating to the Company's business, concerning, amongst other things, the results of operations, financial condition, prospects, backlog, growth and strategies of the Company and the industry in which it operates.

No assurance can be given that such future results will be achieved; actual events or results may differ materially as a result of risks and uncertainties facing the Company. Such risks and uncertainties could cause actual results to vary materially from the future results indicated, expressed or implied in such forward-looking statements. Given these risks and uncertainties, you are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements contained in this announcement speak only as of the date of this announcement. The Selling Shareholder, the Company, the Joint Global Coordinators, the Issue Manager, the Joint Bookrunners, the Collection Agents and/or their respective affiliates, expressly disclaim any obligation or undertaking to release publicly any updates or revisions to any forward looking statements contained in this announcement to reflect any change in its expectations or any change in events, conditions or circumstances on which such statements are based unless required to do so by applicable law.

Oman Investment Bank SAOC (“OIB”), Sohar International Bank SAOG (“Sohar International”), EFG-Hermes UAE Limited, acting in conjunction with EFG Hermes UAE LLC (together, “EFG”), Jefferies International Limited (“Jefferies”) and J.P. Morgan Securities plc (“J.P. Morgan”) have been appointed as joint global coordinators (the “Joint Global Coordinators”) of the Offer, Sohar International Bank SAOG has been appointed as issue manager of the Offer (the “Issue Manager”) and Crédit Agricole Corporate and Investment Bank (“CA-CIB”) and Société Générale (“Société Générale”) have been appointed as joint bookrunners (together with the Joint Global Coordinators, the “Joint Bookrunners”) of the Offer. EFG Hermes UAE Limited is authorised and regulated by the DFSA. EFG Hermes UAE LLC is authorised and regulated by the SCA. Each of Jefferies and J.P. Morgan is authorised by the UK Prudential Regulatory Authority (“PRA”) and regulated by the UK Financial Conduct Authority (“FCA”) and the PRA. OIB is licenced and regulated by the Central Bank of Oman (the “CBO”) and the FSA. Sohar International is authorised and regulated by the CBO and the FSA. Each of CA-CIB and Société Générale is authorised and regulated by the European Central Bank, the Autorité de Contrôle Prudentiel et de Résolution (the French Prudential Supervision and Resolution Authority) and the Autorité des Marchés Financiers (the French financial markets regulator).

The Joint Global Coordinators, the Issue Manager, the Joint Bookrunners, the Collection Agents are acting exclusively for the Company and the Selling Shareholder and no-one else in connection with the Offering. They will not regard any other person as their respective clients in relation to the Offering and will not be responsible to anyone other than the Company and the Selling Shareholder for providing the protections afforded to their respective clients, nor for providing advice in relation to the Offering, the contents of this announcement or any transaction, arrangement or other matter referred to herein.

In connection with the Offering, each of the Joint Global Coordinators, the Issue Manager, the Joint Bookrunners, the Collection Agents and any of their affiliates may take up a portion of the shares in the Offering as a principal position and in that capacity may retain, purchase, sell, offer to sell for their own accounts such shares and other securities of the Company or related investments in connection with the Offering or otherwise. Accordingly, references in the Offering Document, once published, to the shares being issued, offered, subscribed, acquired, placed or otherwise dealt in should be read as including any issue or offer to, or subscription, acquisition, placing or dealing by, each of the Joint Global Coordinators, the Issue Manager, the Joint Bookrunners, the Collection Agents and any of their affiliates acting in such capacity. In addition, certain of the Joint Global Coordinators, the Issue Manager, the Joint Bookrunners, the Collection Agents or their affiliates may enter into financing arrangements (including swaps or contracts for differences) with investors in connection with which they or their affiliates may from time to time acquire, hold or dispose of shares. None of the Joint Global Coordinators, the Issue Manager, the Joint Bookrunners, the Collection Agents or any of their respective affiliates intends to disclose the extent of any such investment or transactions otherwise than in accordance with any legal or regulatory obligations to do so.

The contents of the Company’s website are not incorporated by reference into, and do not form part of, this announcement.